Sale and Leaseback

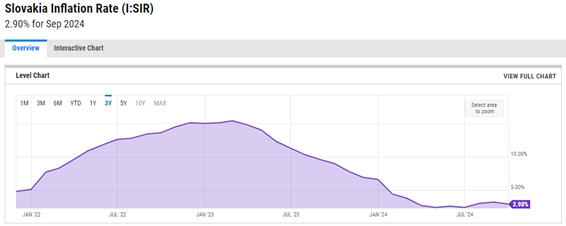

In recent years, European countries, including Slovakia and the Czech Republic, have faced historically high levels of inflation, significantly impacting the business environment. This has led to increased costs for companies in raw materials, energy, production, and operations, thereby substantially reducing corporate profits./contact

Sale & Leaseback as an Effective Solution

High inflationary pressures force companies to seek new ways to optimize their assets and raise capital. One of the most effective methods that has proven successful abroad and is now also being adopted here is the so-called Sale & Leaseback – the sale and subsequent leaseback of real estate.

It allows companies to free up capital tied up in properties while continuing to utilize them. This model proves to be particularly effective for companies that own real estate, such as manufacturing, warehouse, retail, or office spaces. The capital raised can then be invested in their core activities, development, technology, or managing rising costs.

Advantages of Sale & Leaseback

- Capital acquisition at the market value of the property: It allows companies to obtain financing up to the market value of their properties.

- Flexible use of capital: Companies can use the capital raised for investments, repaying obligations, or paying dividends. This enables them to respond flexibly to their business needs.

- Agreed rent and long-term stability: It offers long-term leases (usually for a period of 10 years or more) with an option to purchase, ensuring that companies can continue in the properties without interruption.

- Stable rental costs: Rent is not tied to interest rates—an advantage, for example, during times of higher interest rates. Additionally, rent is tax-deductible as an operating expense.

- Quick access to financing: The process is fast and often more advantageous than traditional loan financing, as it does not require complex approval processes or collateral.

Sale & Leaseback is gaining popularity in our regions, where an increasing number of companies are looking to free up tied capital to support their growth or address rising financial needs. It offers companies an effective way to raise capital while retaining control over their properties, enabling them to face the challenges of the current economic environment.

If you want to learn more, contact the experts at the investment and consulting firm CORE.